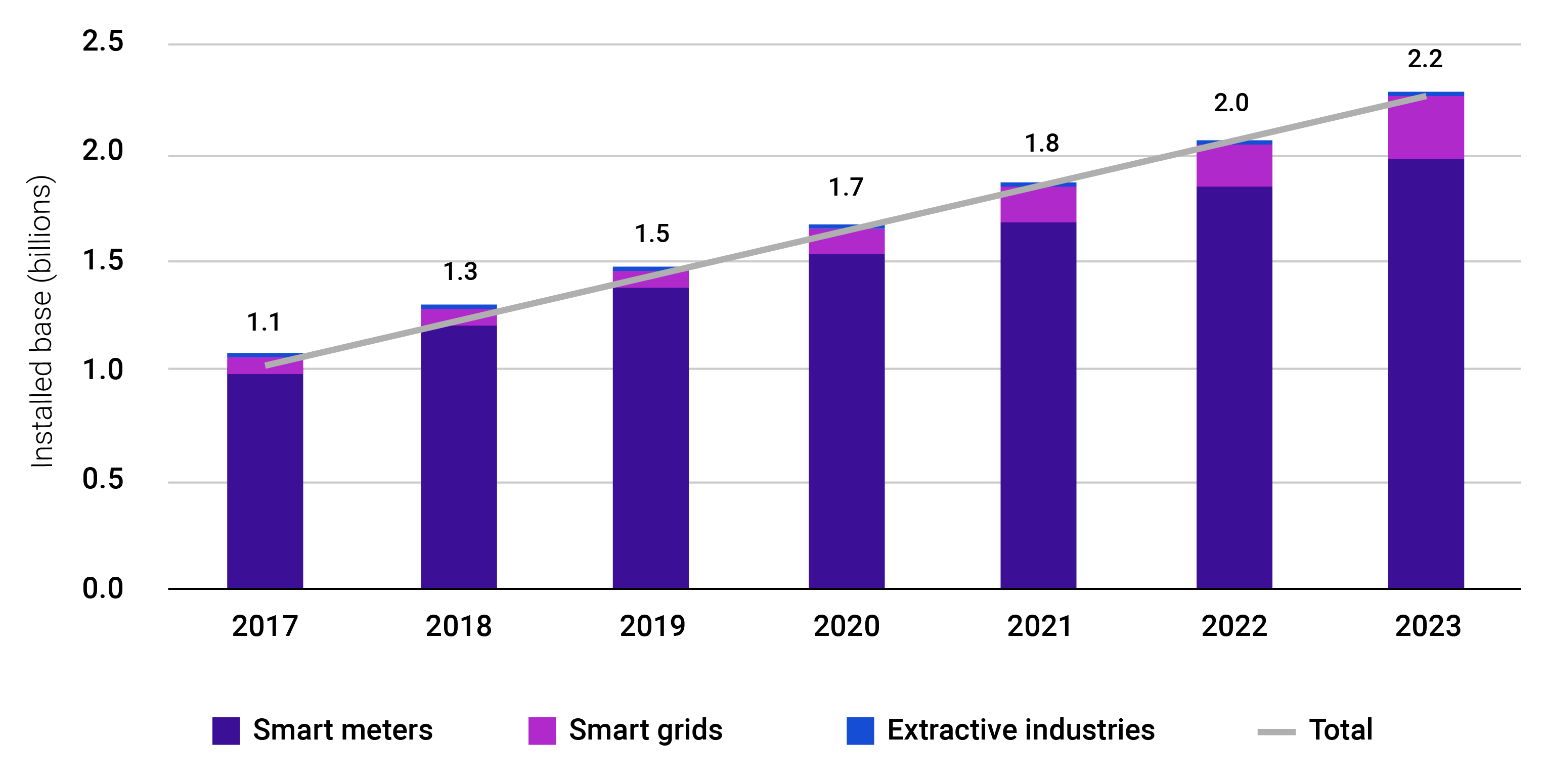

The use of IoT has now expanded from deep within energy and resources production and transport systems, to the edge of the networks where commodities are used, (i.e., customer premises). Regulatory mandates are driving the deployment of smart metering in many countries, along with commercial imperatives. It is therefore not surprising that smart meters – for electricity primarily, and to a lesser extent for gas and water – represent the overwhelming majority of the global installed base of IoT devices in the energy, utilities, and resources vertical. This base passed the 1 billion mark in 2017, and will more than double by 2023 to over 2.2 billion devices.

Figure 1: Smart energy and utilities devices growth – 2017-2023

Source: Ovum IoT Forecast – Energy, Utilities and Resources.

Total service revenue for IoT in this vertical segment – excluding hardware – will represent an annual opportunity of $61bn by 2023, most of which will come from smart meters because of the large size of the installed base. However, on a per-device basis, the annual revenue per smart meter will be far lower than that from IoT devices deployed for smart grids or the extractive industries, where highly tailored solutions will deliver high non-connectivity revenue. This is especially true for the extractive industries, where consultancy, management, application, and platform fees will be higher, due to more complex deployment scenarios and a high requirement for robustness and reliability.

Figure 2: Smart energy and utilities connections by main technology – 2017-2023

Source: Ovum IoT Forecast – Energy, Utilities and Resources. Note: Chart shows revenue-generation connections only. LPWAN includes both licensed spectrum (cellular-based) and unlicensed spectrum technologies.

Wireless low power wide area network (LPWAN) solutions, whether using licensed or unlicensed spectrum, have been hailed as a perfect connectivity technology match for new smart meters, where long battery life meets the requirements of smart meter life expectancy (10–15 years). LPWAN solutions are particularly well-suited for difficult to access meters (e.g., underground water meters) and/or where other technologies cannot reach. However, most of these solutions are still relatively new to the market, and while a number of major contracts have been announced for LPWAN smart metering, most of these will be deployed over years rather than months.

The use of high-bandwidth, low-latency 5G for energy and utilities is likely to have impact first in smart grid management, where low latency and highly flexible and dynamic provisioning of bandwidth will be needed. Limited network coverage is likely to make 5G a longer-term rather than near-term prospect for the extractive industries, while the upcoming generation of smart meters is likelier to rely on the lowest-cost connectivity technology, as these devices have very limited bandwidth requirements.

This article summarises the first edition of Ovum's IoT forecast for devices, connections, and service and connectivity revenues in the energy, utilities, and resources vertical. The forecast was developed in 1Q19. Data is provided for the years 2017 through 2023. The forecast segments the market into three main types of IoT applications: smart meters (including electricity, gas and water meters); smart grids (including IoT devices and connections for all elements of the smart energy grid above the smart metering layer); and extractive industries (including IoT devices and connections for mining and quarrying; oil and gas exploration, extraction and distribution; and related areas).

Alexandra Rehak,

Ovum