REALIGNMENT OF EXPECTATION AS REALITY KNOCKS

CHALLENGES UNDERESTIMATED, PROGRESS OVERESTIMATED

From September to December 2019 AI Summit and Omdia, in partnership with Starmind and Forbes, conducted a survey considering top executives' expectations, frustrations, and attitudes to AI over the coming years. The last decade has seen the explosion of public, business, and governmental interest in AI solutions, however, as 2020 begins questions and disillusion are growing: is AI overhyped, are chatbots the limit of today's capabilities, are we headed for an AI winter?

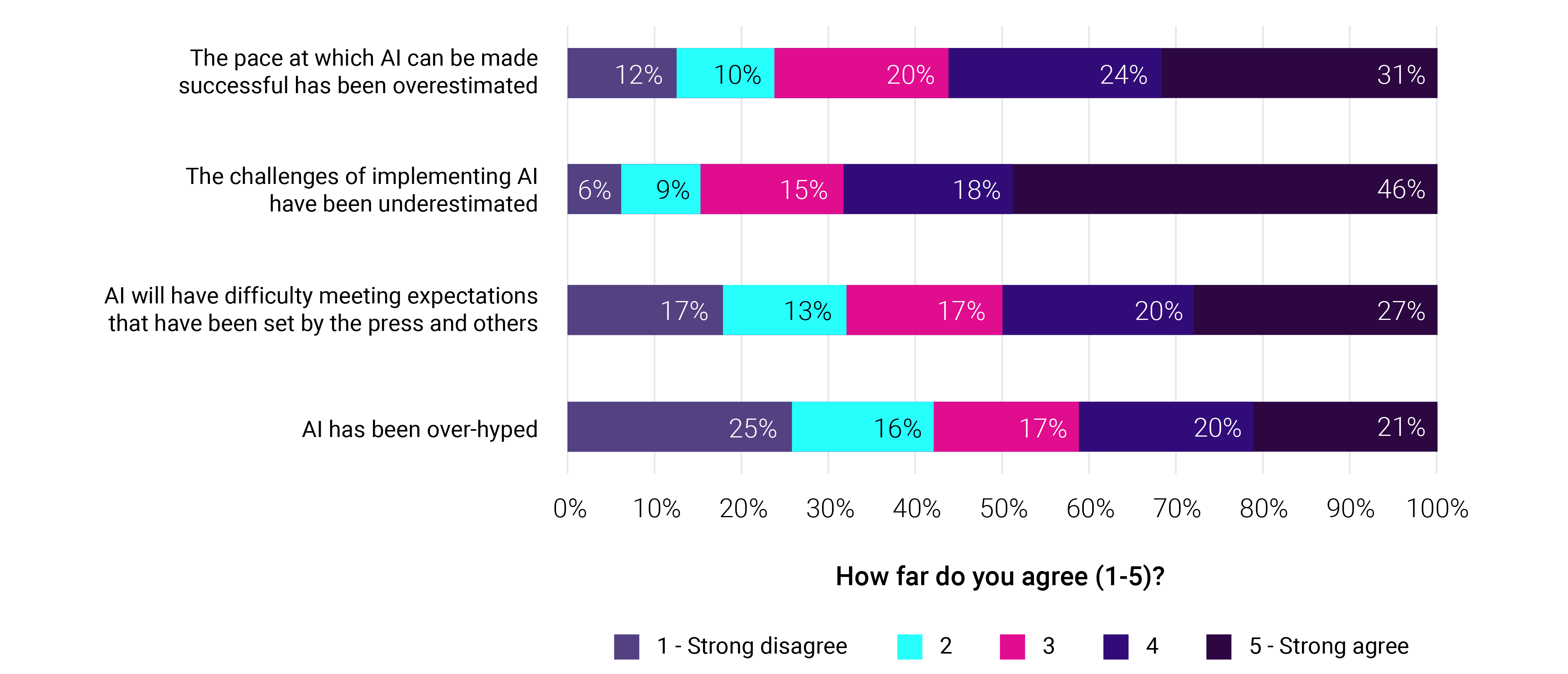

Overall our respondents offered a balanced take on whether AI has been over-hyped, with 41% both agreeing and disagreeing. That said 25% strongly disagreed, four percentage points higher than strongly agreed, suggesting proponents are slightly more adamant on AI's benefits than its detractors. There was greater agreement that AI will have difficulty meeting expectations set by the press and others with 47% in agreement and 30% against the statement that AI will struggle to meet expectations set by the press and others (Figure 1).

Figure 1: Industry sentiment on AI Hype

Industry agreement in AI hype

Source: Informa Tech and Forbes AI Survey December 2019

Even more striking is executive agreement on the underestimation of the challenges involved in implementing AI, and the overestimation of the pace at which AI solutions can be made successful. In our survey 64% agreed – including 46% that strongly agreed – that the implementation challenges of AI have been underestimated. These challenges range from data availability and talent sourcing, to breaking down organizational silos. This underestimation likely reflects the lack of clarity and education that many executives had when they first started to develop and look for AI solutions five, three, or even one year ago.

The overestimation of pace (only 22% disagreed that the pace of AI success had been overestimated) again should be linked to prior lack of clarity and education. In a decade that has seen the enhanced visibility of "AI" affiliated products such as Siri, the Amazon Echo, and facial recognition technologies introduced into our everyday lives, it could be assumed that AI would have become integrated into our business lives at a similar pace. For context, according to Ovum forecasts, there were on average over 1.4 billion active monthly users of AI smart assistants in 2019, set to reach 3.3 billion active monthly users in 2024. These figures are primarily driven by the growth in consumer devices such as smartphones, tablets, and smart home speakers integrating AI assistants into their service offering. That 1.4 billion active monthly users in 2019 is over 14 times that of average active monthly users in 2015, which was estimated at 93.3 million users (Ovum, May 2019). This pace of adoption in the last five years has yet to be reached in the enterprise sphere.

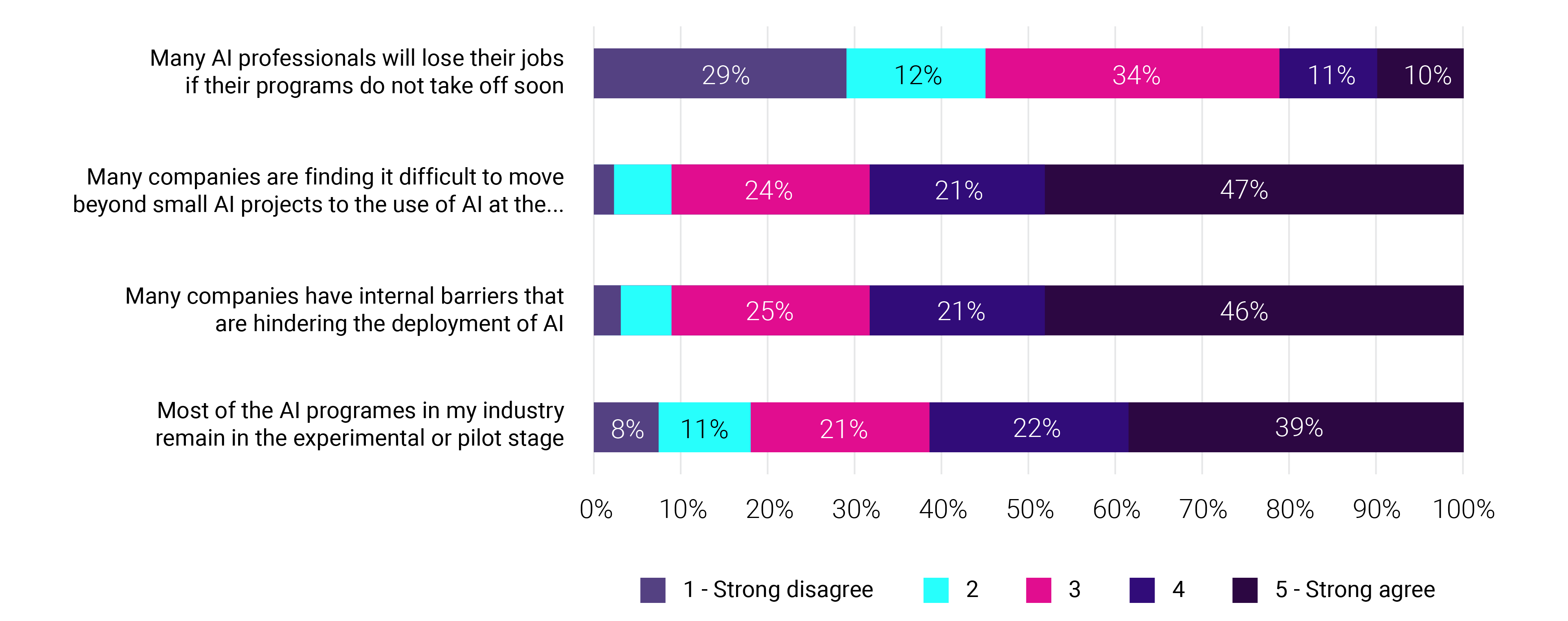

Again, there was broad agreement (over 60%) that many companies are struggling to develop AI beyond the experimental and pilot stage. This was judged to be a disappointment to senior management (41% agreed versus 19% disagreed, with 40% undecided).

Diving down deeper there was wide agreement that most AI programs remain in the experimental or pilot stage, are having difficulties in scaling across enterprises, and that internal barriers are hindering the deployment of AI, with over 60% of respondents agreeing in each case. On the brighter side it is not expected that delays in AI programs will see AI professionals lose out, with only 21% expecting job losses (Figure 2).

Figure 2: How are AI programs in your industry progressing?

Industry agreement on process of AI solutions

Source: Informa Tech and Forbes AI Survey December 2019

In fact, as shortage of talent was ranked as the joint third greatest challenge to scaling small AI projects to go across enterprises alongside integration of disparate data sets, the opposite should be true. The need for more talent is a hindrance to scaling AI projects to date, so is likely to both continue the trend of an increase in hiring, and see businesses put greater emphasis on upskilling their current workforce where talent is unavailable.

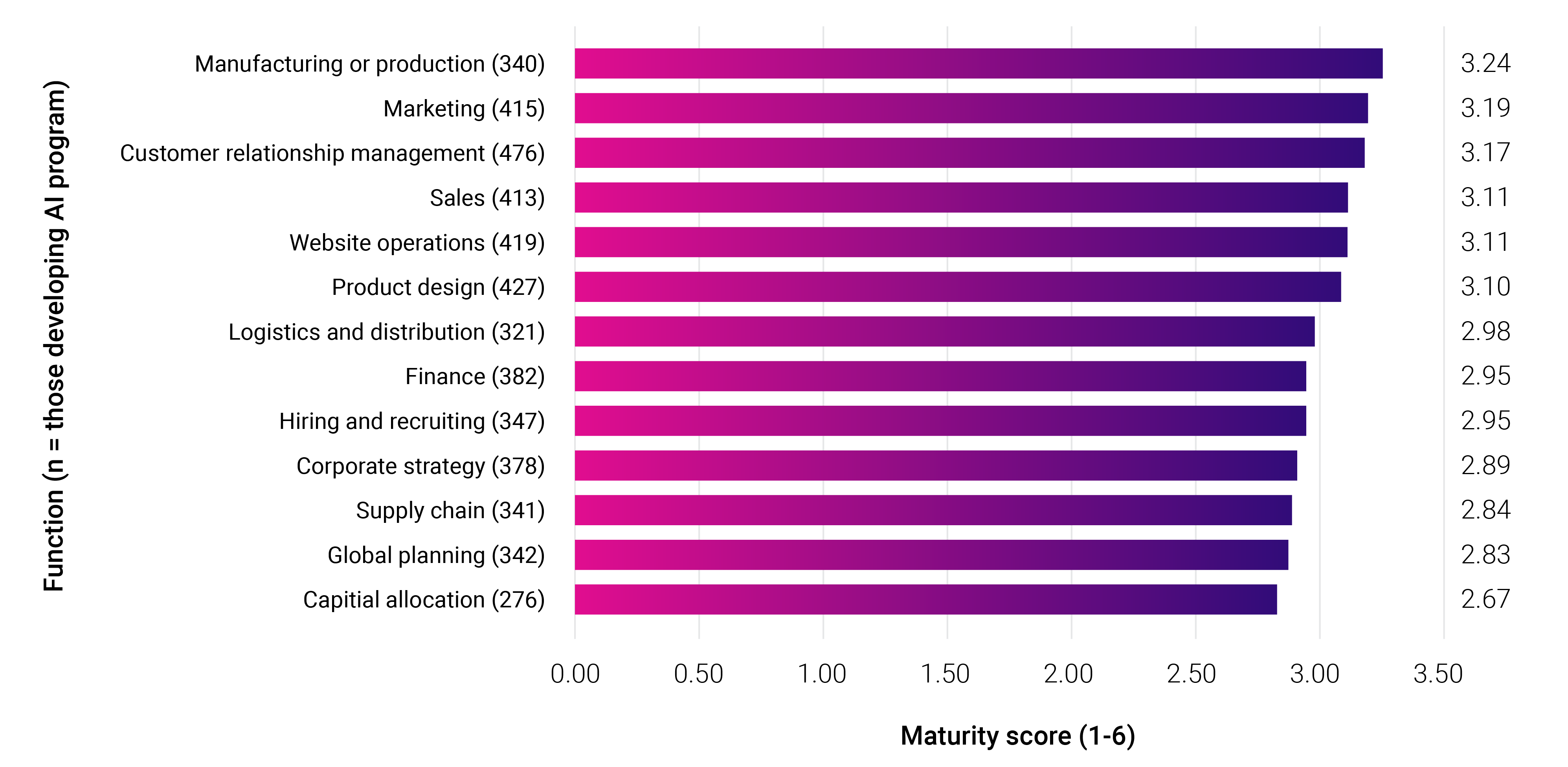

MOST FUNCTIONS IN THE EXPERIMENTAL AND PLANNING PHASE

Our survey took 13 AI functions asking respondents to rank the current stage of development of AI programs in each function in their business. These were then scored between one and six, with six given for those where businesses judged they had reached AI's full potential, while one represented where the function was not launched, but on the roadmap to implement. For each function respondents not developing AI in this function and "don't knows" were discounted. Our range of average maturity scores goes from 2.67 to 3.24. This places each function either between the "planning only" and "experimental" stages and the "experimental" and "pilot" stages (Figure 3).

Figure 3: Function Maturity Rating

Rate the current state of development of your company's AI program(s) within each function

Source: Informa Tech and Forbes AI Survey December 2019

Though manufacturing or production rests at the top with a maturity rating of 3.24, it should be taken that marketing, CRM, sales, website operations and product design are overall likely to be further advanced. This is due to the greater focus on these functions by the industry, with each being developed by over 400 of our respondents. Marketing, CRM, and sales were also the three functions judged to have the greatest growth potential; manufacturing and production was fourth. Website operations were not seen as a high growth area for AI functionality, but were judged to be an environment with some of the lowest barriers to development.

At the bottom of the scale is capital allocation, which has both the lowest rating and the lowest participation rate at sub 300 responses. It was also judged to be the area of lowest opportunity for growth, and sixth most difficult environment for developing solutions. For those solutions providers targeting this sector partnership with key customers in industries with high levels of CAPEX intensity, such as telecoms, which has a CAPEX benchmark in the mid-high teens, will be key. Corporate strategy is another area of note as it was judged the most difficult environment to develop AI solutions in by nearly a quarter of respondents, with one of the lowest opportunities for growth. Despite this it has one of the higher participation rates from respondents showing the universality of this function.