DREAMING OF A CROSS

ENTERPRISE AI

CHALLENGES

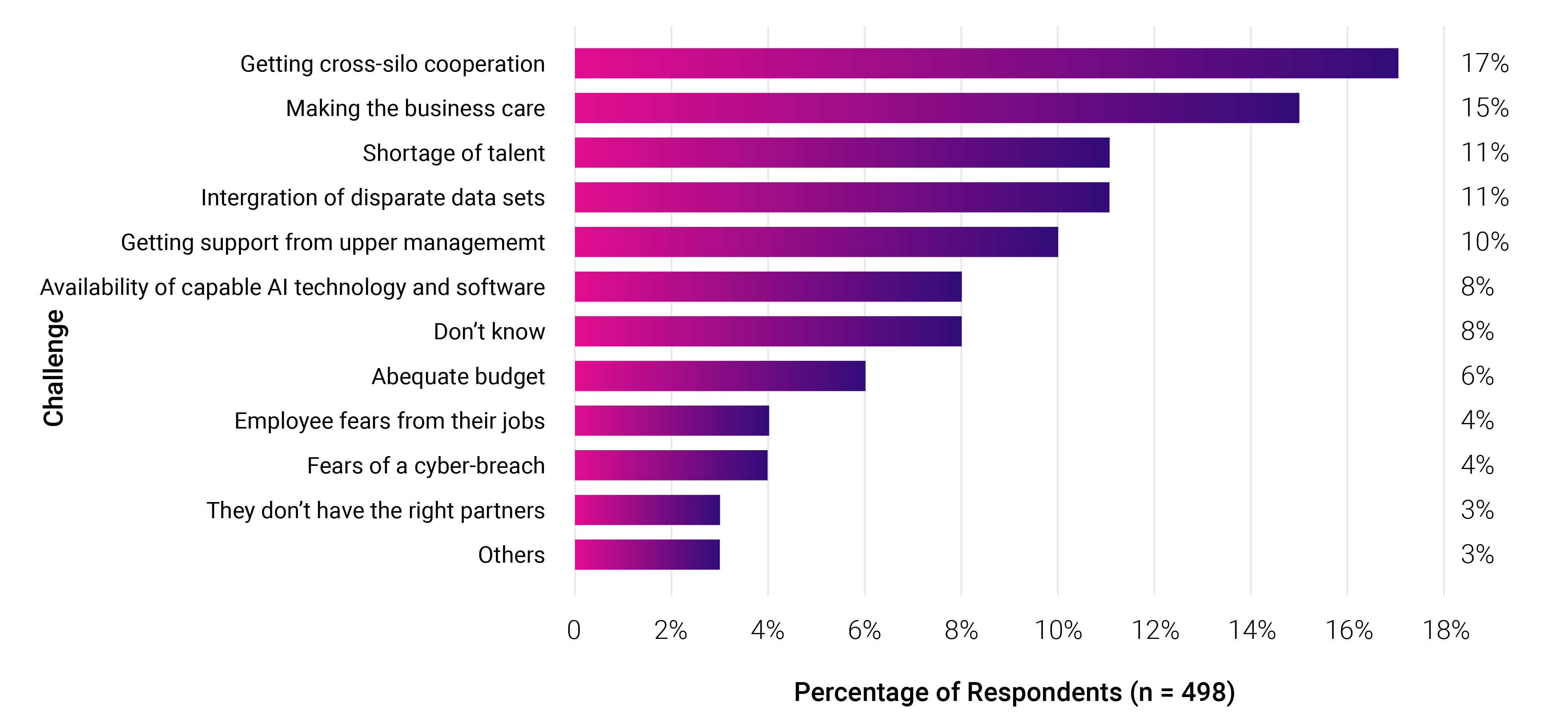

The key challenges are not with the technology, but the enterprise. Chief among them in our survey are cross-silo co-operation with 17% and making the business case at 15% of respondents (Figure 4).

Figure 4: Key challenges in building cross-enterprise solutions

What is the foremost reason that large companies will not advance beyond running small AI projects to true cross-enterprise AI?

Source: Informa Tech and Forbes AI Survey December 2019

Combined with the three following challenges of shortage of talent, integration of disparate data sets, and support from upper management this all points to a lack of an overall enterprise strategy holding back cross enterprise projects. Integration of disparate data sets should be seen as a part of gaining cross-silo cooperation and an enterprise wide attitude to data cleanliness. The more co-operative data silos are, the more standardized a data template can be implemented, the easier it will be for enterprises to develop AI solutions for their cross-business needs.

Together these top five challenges represent 64% of respondents and underpins that the lack of holistic vision and strategy is holding back scaling up cross enterprise AI solutions, well before we get to the availability and capability of AI technology and software. A key component of this vision must be for enterprises to adopted unified and standardized attitudes to their data as a key steppingstone to building both a business case, and the tools with which to develop solutions to the enterprise' most pressing needs.

PETITION THE BOARD

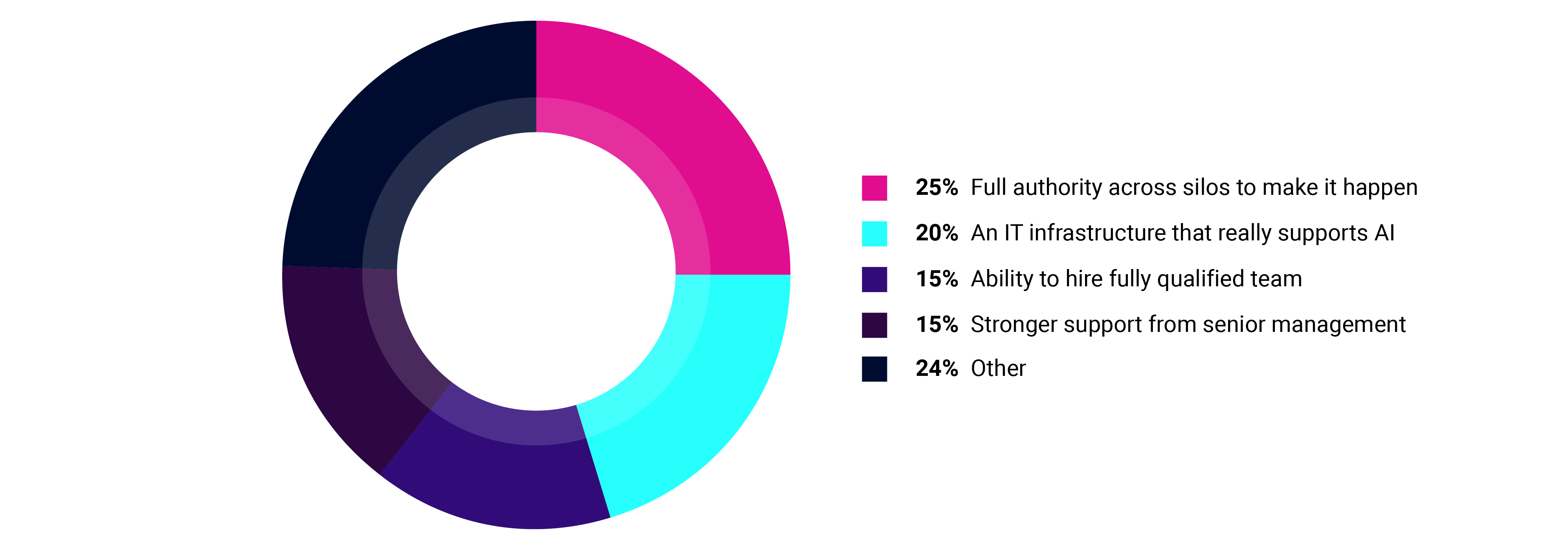

To overcome these challenges, we asked our enterprise respondents to make a plea to their Board of Directors and consider what one thing could allow them to make real headway in developing AI solutions for their business. Unsurprisingly, considering our challenge response, the number one ask was for "authority across silos to make it happen" by 25%, backed up by a further 15% who want "stronger support from senior management" (Figure 5).

Figure 5: What would you ask the Board of Directors for?

If you could ask your Board of Directors for one thing what would it be?

Informa Tech and Forbes Survey December 2019

This again underlines that without a clear single vision for what AI can do and needs to do for the business, challenges such as breaking down silos and standardizing data are extremely difficult for organizations to overcome. These challenges grow exponentially the larger the scale of the enterprise.

Second comes an "IT infrastructure that really supports AI" with 20% of respondents, which is in turn supported by a further 15% who would ask for the "ability to hire a fully qualified team." Developing a cross enterprise IT structure is another task to be driven forward by a central vision but can be incorporated into current enterprise digital transformation roadmaps. This will need to be supported by a fully qualified team otherwise it could be an expensive mistake waiting to happen. Without the proper talent in place costly transformation projects will be unable to achieve their full return on investment.

While these pleas do have implicated costs, it is important to note that they all respond to the core challenges and seek to solve critical organizational problems to developing AI. They represent the asks of 75% of our sample, only 10% asked for a "bigger budget" without priority and just 5% asked for a "larger budget for consultants and solutions providers." Enterprises executives can articulate the key business priorities, now it is time for boards and senior enterprise leaders to take this and build a one enterprise, one AI vision.

ACHIEVING ONE ENTERPRISE, ONE AI VISION

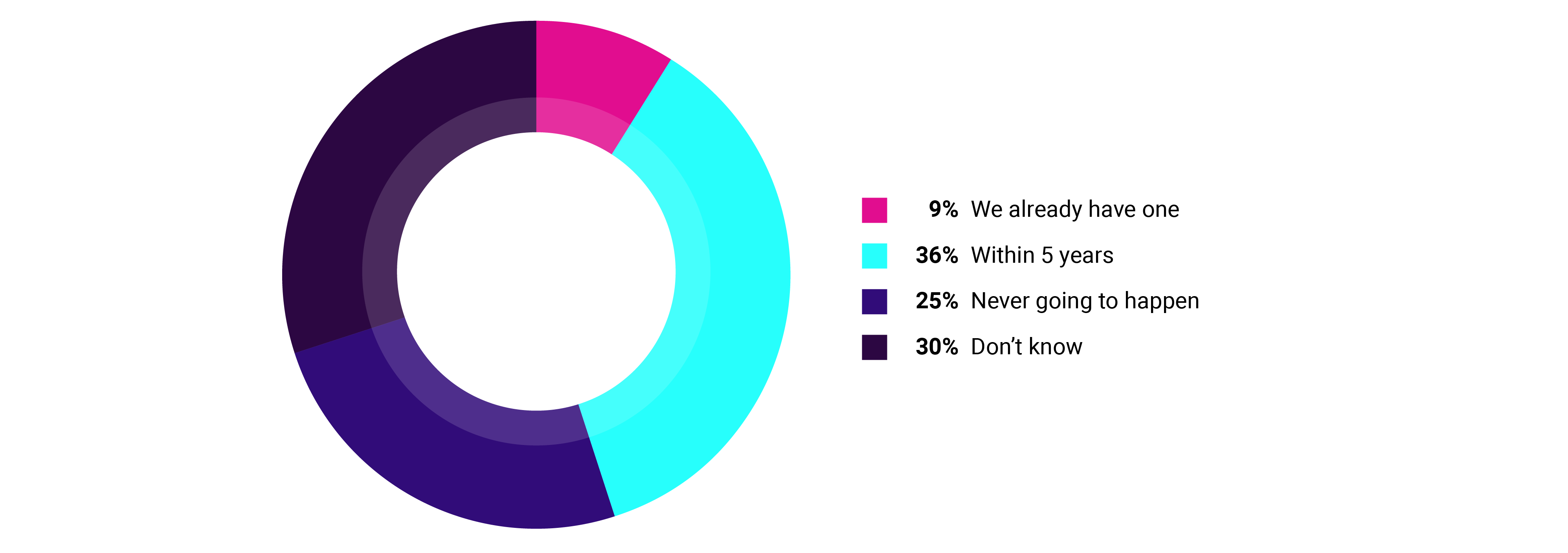

If a business is serious about developing a unified AI strategy to drive forward adoption of solutions cross-enterprise, then it could consider creating a CAIO role. In our survey, 9% have already appointed a CAIO, while a further 36% expect to have one named within the next 5 years. This was matched by 25% who do not believe their company will ever have a CAIO and 30% who do not know when this could happen (Figure 6).

Figure 6: When will a CAIO be named in your company?

When if at all do you believe a Chief Artificial Intelligence Officer will be named in your company?

Source: Informa Tech and Forbes AI Survey December 2019

For businesses not considering a CAIO role, there should be serious consideration of which function will spearhead cross-enterprise solutions at this level. For many this could result in a mandate for a CIO or CDO. For those companies which have or plan to have a CAIO the questions should be for how long? While there is likely to be significant pay-off for appointing a CAIO in the short- to mid-term to develop a unified strategy and ensure delivery of that strategy across silos, questions should be asked on the sustainability of the CAIO role once solutions are in place.

However and whoever businesses charge with delivering their AI strategy it should be recognized that delivering a fully AI enabled business entails a fundamental change in how businesses will run. The appointment of a CAIO or clear tasking of another C-suite executive will signal to investors, employees, and other key stakeholders just how importantly a business is taking its AI transformation.

Where to play, what to push?

Businesses are not and should not try and develop every applicable AI function at once. The expenditure and repetition of organizational effort would be debased by later efforts to unify cross-silo AI functions. For those driving cross enterprise strategies they need to be able to fit their strategy to the core business needs of the enterprise before moving to enhancing other parts of the business.

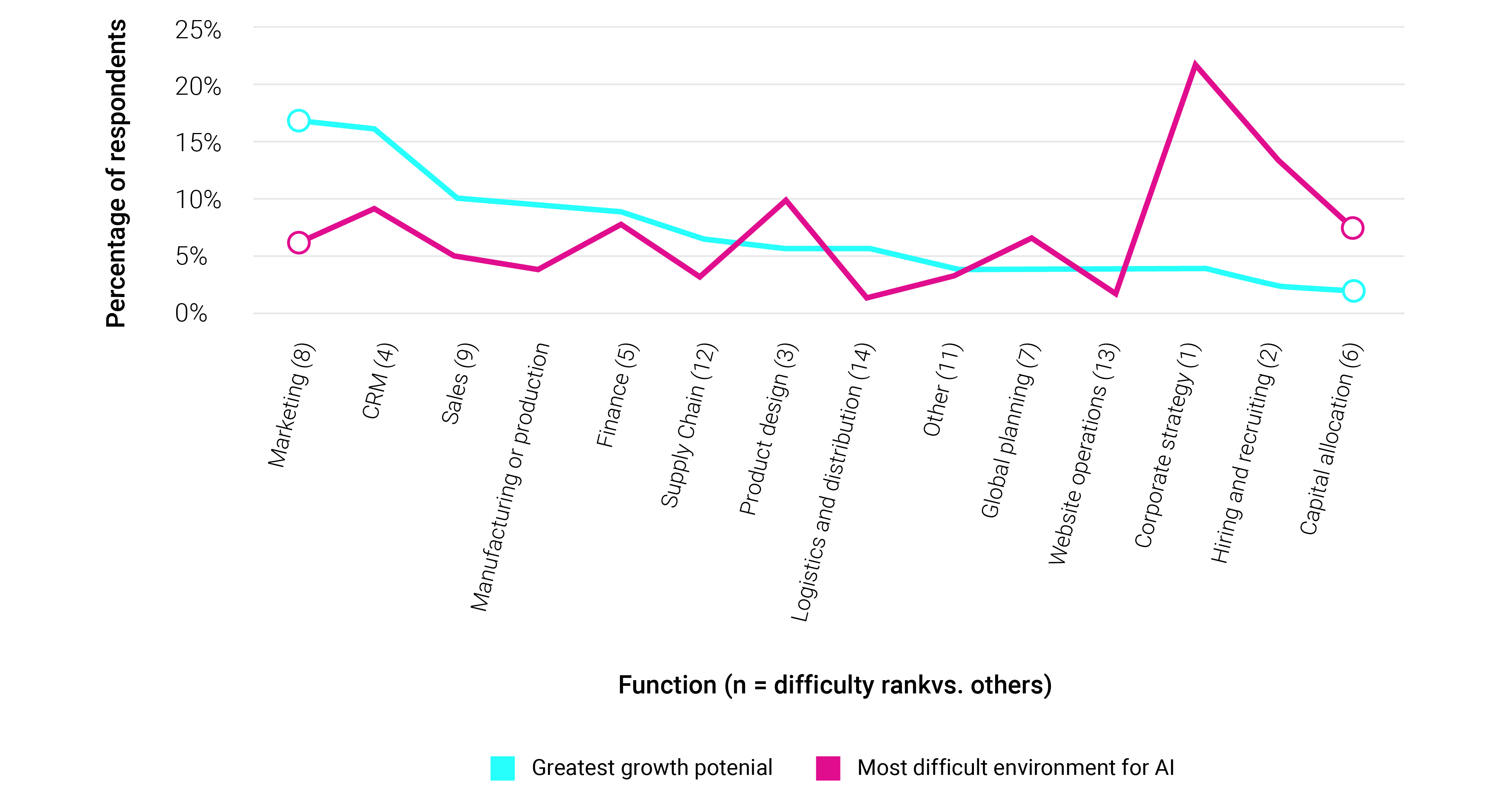

That said, corporate strategy is also one area which could benefit from the development of AI solutions, but was rated as the most difficult environment to develop for by 24% of our respondents, with hiring and recruitment a close second identified by 20% (Figure 6).

Figure 6: Which functions present the greatest potential/most difficult environment for the growth of AI?

Functions with greatest potential for the AI vs most difficult enviroment to use the AI

Source: Informa Tech and Forbes AI Survey December 2019

These areas were also near the bottom of our list of opportunities for AI to grow. The difficulty rating of both reflect the high levels of potentially subjective judgement involved that need to consider wide, and often competing, sets of KPIs. Quantifying and qualifying the elements that direct these sensitive decisions in a data form is difficult for the industry to grapple with, especially as neither are usually seen as key business priorities. This also touches on the problem of explainable AI. Both are examples of the need for accountable AI solutions. If a corporate decision were not to pay off, the board of tomorrow will not except the excuse of "the AI said to do it" just as much as the work tribunal of today would not accept nepotism as a good reason to hire one candidate over another. Solution providers who can build their solutions in an explainable manner will be best placed to handle these trickier markets, and in time gain greater traction in most sectors compared to their closed box counterparts.

In our survey, respondents highlighted marketing as the function with the greatest potential for the growth of AI, followed closely by customer relationship management (CRM). These areas have been a particularly visible success story for the applicability of AI in the last couple of years with the proliferation of chatbots and intelligent customer targeting solutions growing, fed by the quantity of data enterprises have been able to provide solution providers, and the circumstantial data gathered through cookies and the likes of Google, Facebook, and Amazon. Both are also easily applicable to any business, giving plenty of growth opportunities to solution providers who can first corner their particular target industry, and then can scale their expertise into neighboring market sectors.

A higher difficulty rating does not mean that enterprises should not prioritize a "difficult" AI function if critical for their business. Large telecoms companies, such as AT&T in the US, which planned to spend $23bn on CAPEX in 2019, have greater incentives to prioritize capital allocation solutions than Sainsbury's, the UK retailer, which planned to spend £550m ($721m).